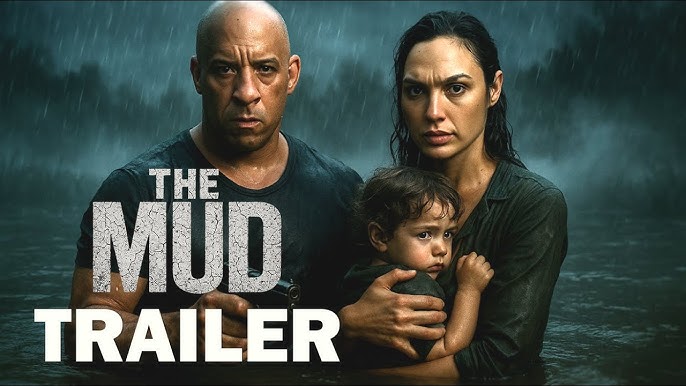

The Mud (2025)

Starring Vin Diesel

Don’t miss the highly anticipated The Mud (2025), led by the unstoppable Vin Diesel alongside the magnetic Gal Gadot. Set on a dazzling island along the Mississippi River, this film promises a thrilling adventure steeped in intrigue, explosive action, and powerful human connections.

As the story unfolds, two young wanderers cross paths with a mysterious stranger whose captivating tales pull them into a hidden world of legendary bounty hunters and a woman as enchanting as she is dangerous. The Mud (2025) dives deep into timeless themes of friendship, the pursuit of truth, and the eternal clash between good and evil.

Fueled by commanding performances and undeniable chemistry between Diesel and Gadot, this film is set to mesmerize audiences — weaving adrenaline, mystery, and passion into a cinematic experience you’ll never forget.