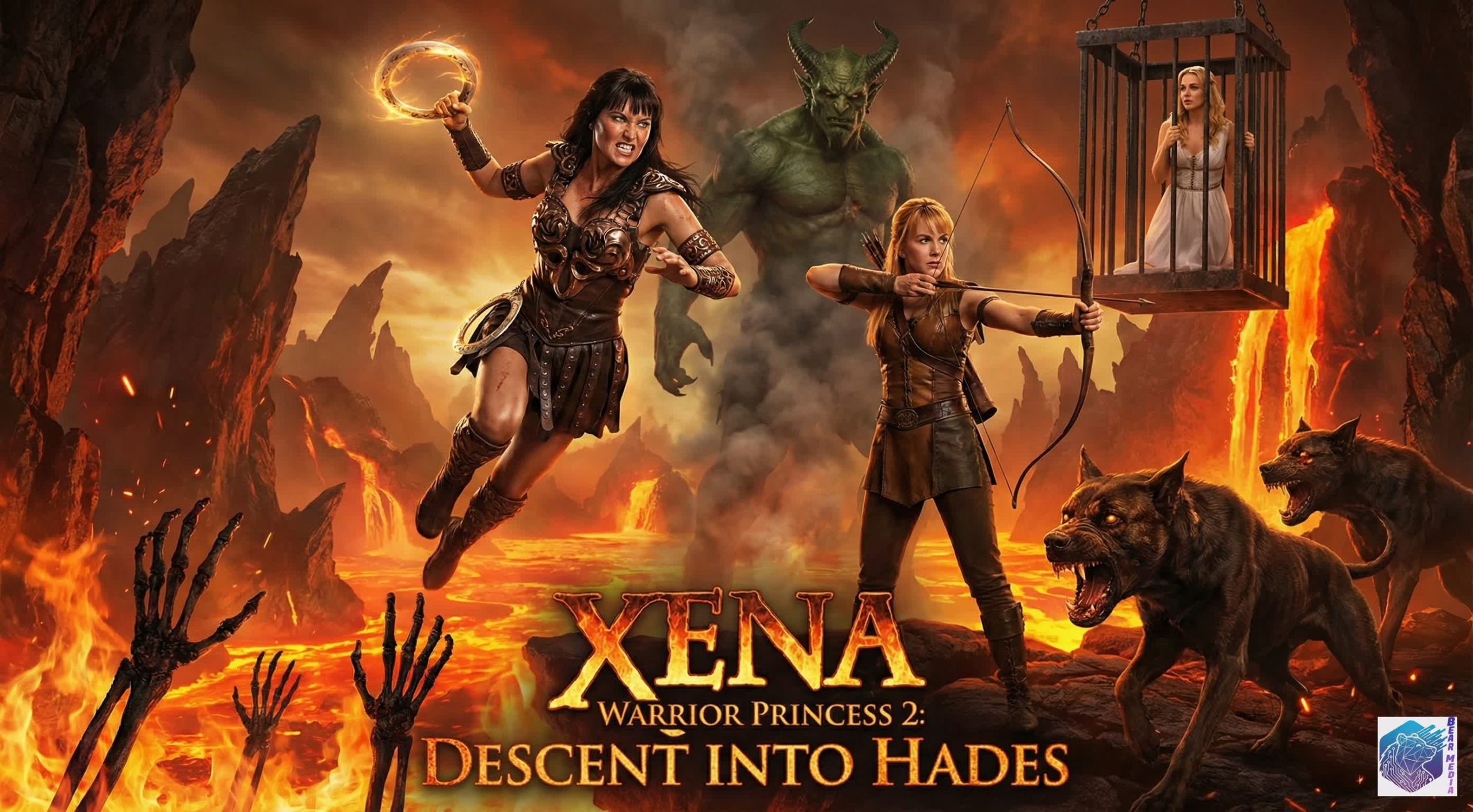

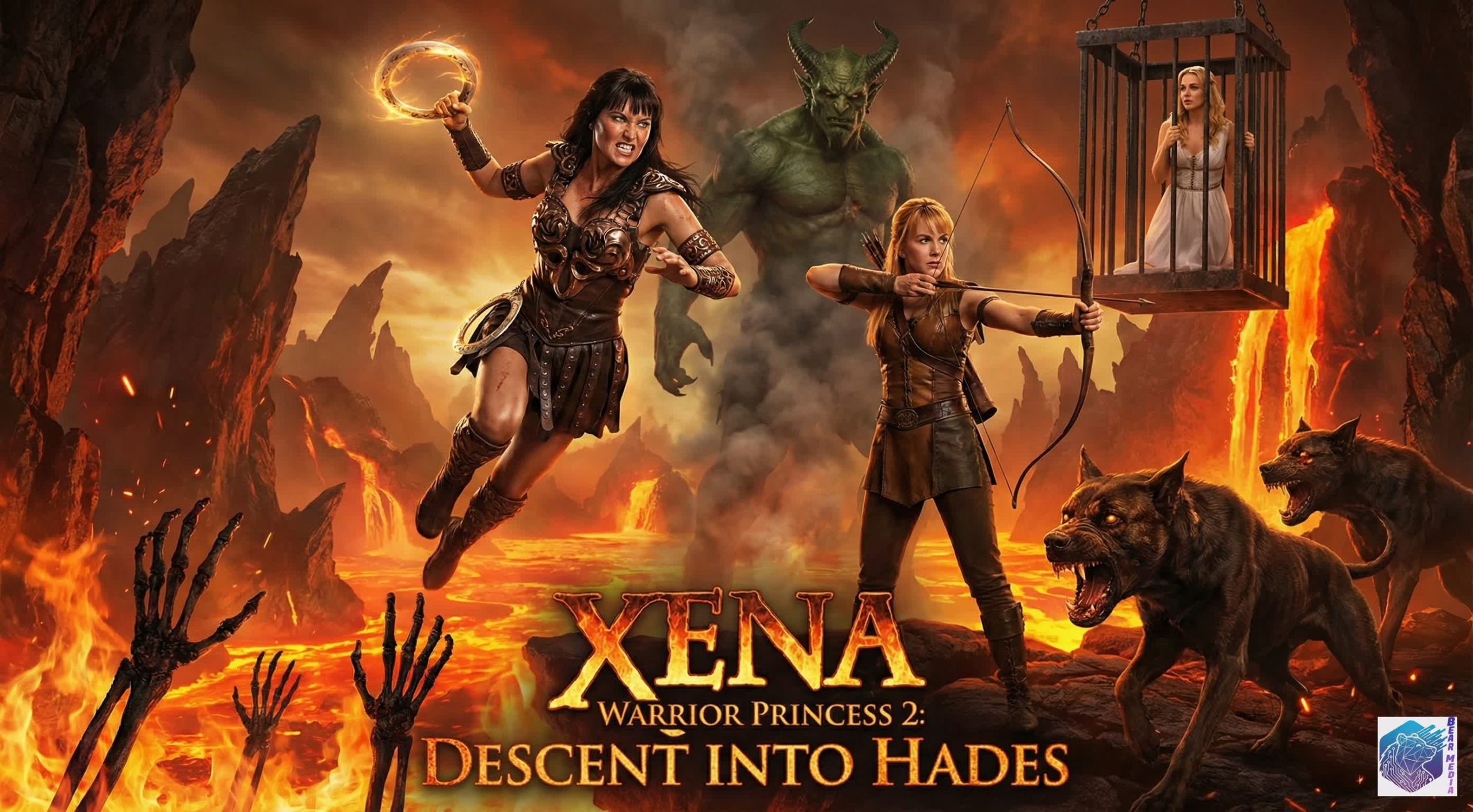

Xena: Warrior Princess 2 – Descent into Hades (2026) – Official Main Trailer

![]() Starring: Lucy Lawless, Kevin Sorbo

Starring: Lucy Lawless, Kevin Sorbo

![]() “When the gates of Hell swing wide, a legend must dive into the flames to reclaim a soul lost to the abyss.”

“When the gates of Hell swing wide, a legend must dive into the flames to reclaim a soul lost to the abyss.”

![]() Overview: The Chakram is flying once more in a breathtaking journey through the underworld! The official trailer for Xena: Warrior Princess 2 – Descent into Hades has finally ignited, revealing a visceral and gothic expansion of the warrior’s odyssey. Lucy Lawless returns as the iconic Xena, battle-scarred and leaping through a rain of fire as she faces a horde of skeletal ghouls and snarling hellhounds. Alongside her, a battle-ready Hercules (Kevin Sorbo) draws his bow against a gargantuan, red-eyed demon looming in the emerald mists. As Gabrielle dangles in a celestial cage above the molten pits of Hades, the footage teases a pulse-pounding symphony of steel, myth, and sacrifice. This isn’t just a battle; it’s a war for the very soul of a princess.

Overview: The Chakram is flying once more in a breathtaking journey through the underworld! The official trailer for Xena: Warrior Princess 2 – Descent into Hades has finally ignited, revealing a visceral and gothic expansion of the warrior’s odyssey. Lucy Lawless returns as the iconic Xena, battle-scarred and leaping through a rain of fire as she faces a horde of skeletal ghouls and snarling hellhounds. Alongside her, a battle-ready Hercules (Kevin Sorbo) draws his bow against a gargantuan, red-eyed demon looming in the emerald mists. As Gabrielle dangles in a celestial cage above the molten pits of Hades, the footage teases a pulse-pounding symphony of steel, myth, and sacrifice. This isn’t just a battle; it’s a war for the very soul of a princess.

![]() Rating: 9.9/10 A staggering, visually transcendent masterpiece that blends gritty ancient warfare with hauntingly beautiful supernatural horror—the ultimate epic return!

Rating: 9.9/10 A staggering, visually transcendent masterpiece that blends gritty ancient warfare with hauntingly beautiful supernatural horror—the ultimate epic return!