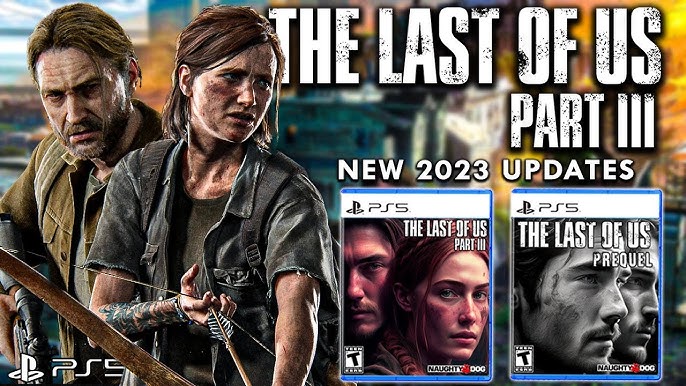

The Last of Us – Part 3 (2026)

The Last of Us – Part 3 offers a powerful narrative that transcends the boundaries of video game storytelling. Set in a post-apocalyptic world, this installment immerses us in the emotional journeys of its characters, focusing primarily on themes of redemption, loss, and survival. The game’s captivating plot, which combines heartbreaking moments with moments of unexpected hope, challenges players to confront complex moral dilemmas.

From the first scene, the atmosphere feels dense, as the remnants of the world are rendered with stunning realism. The character development is exceptional, with each returning character evolving significantly. Whether following Ellie’s path, grappling with her inner conflicts, or encountering new characters whose motivations add layers of intrigue, the emotional tension is high throughout.

In terms of gameplay, the title builds on its predecessors, offering refined mechanics that enhance the already thrilling action. Stealth sequences are more nuanced, combat feels more immersive, and the environments are lush, allowing for more fluid exploration of the devastated world. The artificial intelligence (AI) is sharper than ever, making every encounter feel intense and dynamic.

The sound design and music, created by the talented Gustavo Santaolalla, continue to move the player, with captivating melodies that resonate with them long after they’ve put down the controller. The attention to detail in each scene adds an emotional depth rarely seen in video games.